[A&S magazine]

Security 50: Top 10 manufacturers in surveillance and access control

2022 saw marked growth in the market for the majority of the Security 50 companies in video surveillance and access control. However, the year is ending with the physical security industry dealing with issues that will point to major challenges in the year ahead.

Get the full list of the top 50 security companies here >https://www.asmag.com/rankings/security50_rankings.aspx

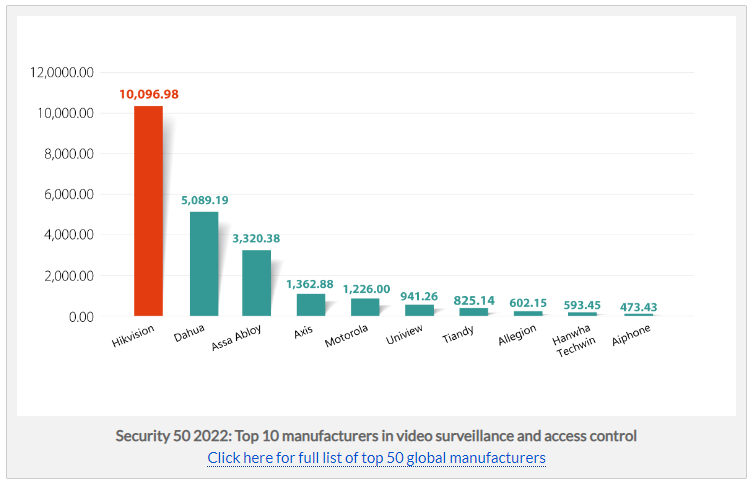

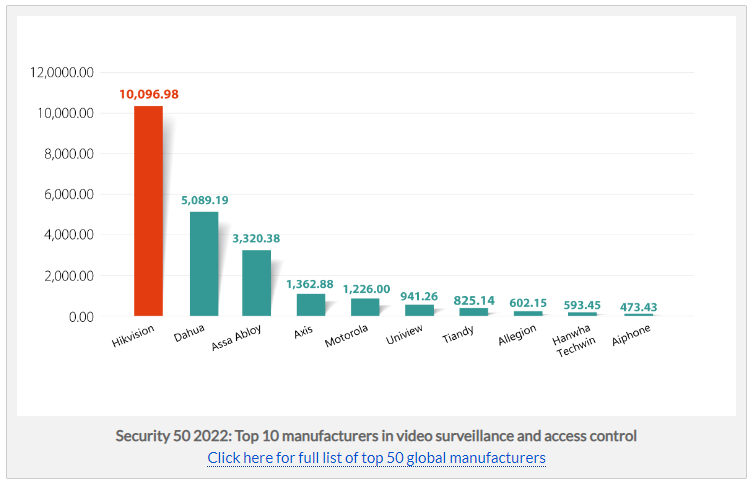

Looking at this year's Security 50, we can see the Top 10 companies remain somewhat consistent. The top 10 biggest manufacturers in video surveillance and access control (based on 2021 revenue of security product sales) is Hikvision Digital Technology, Dahua Technology, ASSA ABLOY, Axis Communications, Motorola Solutions, Uniview Technologies, Tiandy Technologies, Allegion, Hanwha Techwin and Aiphone. Of note, Hikvision's 2021 revenue exceeded the US$10 billion mark, standing at $10.1 billion, growing 16.9 percent from 2020's $8.64 billion.

"We believe that technological innovation is the key element for successful development of a tech company. Our innovative technologies, products and solutions are creating values for customers, and helping many different people and types of organizations increase safety, operational efficiency and sustainability. We are glad to see that customers demonstrate long-term trust in us in return, which supports growth of the company," said Frank Zhang, VP of Hikvision. "We have noticed that more external uncertainties emerged last year and this year, as inflation, interest rate hike, and exchange rate changes are affecting growth of different economies. Through optimizing our operations with enhanced flexible manufacturing processes, logistics and localized service, Hikvision has successfully maintained product delivery efficiencies. And we have kept consistent investment in technology research and development, with the R&D spending accounting over 10 percent of our total revenue in 2021. All these efforts ensured continued positive development of the company."

Six companies are new entrants to Security 50 this year. They are: Dnake (intercom), Jovision (video) and EVETAR (lens), all from China; as well as Evolv, a U.S.-based screening solutions provider; Ava Group, an Australian risk management solutions provider; and Webgate, a Korea-based video surveillance company.

For Chinese companies, a total of 15 are in Security 50 this year. Among them, Hikvision, Dahua, Uniview and Tiandy are within Top 10. Most Chinese companies reported 2021 growth, indicating impacts from U.S.-led trade sanctions on Chinese goods were limited.

It's interesting to note, however, that a lot of Chinese companies reported year-over-year revenue declines in the first half of this year. Hikvision, meanwhile, posted a total net profit of $848.6 million in the first half of 2022, down 11.14 percent from the first half of 2021, though its 2022 H1 revenue increased 9.9 percent y-o-y.

Yet this has more to do with China's own domestic COVID and other issues, rather than the trade conflict itself. "Much of this is down to conditions in the Chinese domestic market rather than tariffs and trade restrictions in the US. The first half of 2022 has seen restrictions on movement in several major Chinese cities due to the COVID-19 pandemic. Government spending has therefore been diverted away from other areas and towards battling COVID-19 and supporting its economy during lockdowns," said Josh Woodhouse, Lead analyst and Founder, and Jon Cropley, Principal Analyst, of Novaira Insights.

Speaking of U.S.-China trade conflict, all eyes are watching whether Taiwan security makers have benefited. Upon an initial look, this is indeed the case as certain Taiwan companies, including Dynacolor, Hi Sharp and GeoVision, reported good growth in 2021. Yet given Taiwan manufacturers' smaller scale and capacity, whether they can continue to benefit from OEM orders transferred from China remains to be seen. In fact, most Taiwan manufacturers have re-strategized to make niche, value-added solutions in, for example, smart transportation, and that has been one of the contributing factors to their successes.

2021-2022 review: Growth returned to physical security market

Looking back at 2021 and 2022, indeed growth returned to security due to an easing of the pandemic. "With more availability of vaccines and treatments for COVID-19, many businesses were able to start pivoting their business strategies towards creating a safe environment for employees and customers to return to physical spaces, while also maintaining (and even expanding) the remote solutions implemented during the height of the pandemic," said Danielle VanZandt, Senior Industry Analyst for Security at Frost & Sullivan. "For many security technology markets, spending and investment opportunities returned back to their pre-pandemic levels, with some technologies witnessing further gains due to ongoing digitalization initiatives-markets like biometrics, access control, video analytics, and digital intelligence all witnessed significant growth this year."

Across the global markets there is a solid underlying market growth ... One driver for that is the overall increasing interest in security and network video solutions. Another driver is that of technology development. The demand for our products increases as we develop new and more innovative products and solutions to address customer demands," said Ray Mauritsson, CEO at Axis Communications.

2023 forecast: Challenges lie ahead for security industry

Just when we thought the pandemic nightmare was about to be over, a new set of challenges and difficulties have emerged, impacting various industries including security. A post-COVID surge in demand, as well as the aftermath of regional conflicts, have triggered the worst supply chain crisis in a generation. This has also partially contributed to out-of-control, across-the-board inflation in a range of areas, from energy to food to consumer products. To curb inflation, interest rates have been hiked to the highest in years, raising the spectre of recession. Indeed, the world we knew pre-COVID has changed, and, despite a return to growth in security, the above-mentioned challenges bode not so favorably for the industry in the coming year.

Supply chain issues

As mentioned, the security industry is now faced with certain challenges, one being the worst supply chain crisis in decades. "As with many other companies, we have been affected by supply chain issues. Lockdowns and other disruptions caused by the pandemic was one factor. The shortage of components, which was worsened by the pandemic, was also a major factor. Product re-designs and spot market component purchases has been two examples to minimize the effect of supply shortages. Longer lead times led to slower growth than expected in 2020 and 2021. As we now are starting to see improvements in our supply chain, we are expecting to return to double-digit growth," Mauritsson said.

Of all the component shortages, semiconductor shortages were particularly severe. This, then, has produced ramifications for security players. "Restrictions on movement due to the COVID-19 pandemic caused a surge in demand for consumer electronics. People required laptops to work from home and for home-schooling and spent more of their income on home entertainment. All this equipment required semiconductors causing huge growth in demand for them. Video surveillance equipment vendors were just one group competing for supply of semiconductors. Car manufacturers and smartphone producers were among the other groups," Woodhouse and Cropley said.

"As far as components, one of the hardest hit technologies was in chips for any type of processor for analytics, intelligence functions, or edge capabilities. These were high in-demand solutions from all customers, so securing components in a timely manner became a key differentiator for projects pitched and won over the last year. Security vendors who were able to diversify their supply chains to secure these components and not feel the impact of adjusted logistical routes globally found themselves to be the ultimate winners," VanZandt said.

Inflation

Inflation is also now affecting a range of industries including security. "The price of video surveillance equipment is now being impacted by inflationary pressures in the wider economy. With utility prices, labor costs and raw material costs all rising quickly, video surveillance vendors will be forced to pass on cost increases to their customers in the form of equipment price increases. The average price of a network camera is forecast to increase in both 2022 and 2023," Woodhouse and Cropley said.

Amid the price increase, security players had to re-strategize and think of ways to retain customers. "Inflation has caused costs to raise across the board and security technology components were not an exception to this. Many vendors and integrators did have to increase their prices in order to counter this, but they turned towards offering more flexible payment models for customers, as many projects did have longer timelines than they typically would," VanZandt said. "Additionally, much of the industry focus has turned towards enhancing the overall customer experience including offering more personalized service models. Not only does this service-based approach fit with the overall trends of the industry, but it also helps vendors to prevent significant levels of customer churn."

Other challenges

Geopolitical conflicts in certain parts of the world have also taken a toll on security players. "The ongoing geopolitical issues that we see is of course causing concern and uncertainty. For instance, we have, as did many other companies, suspended our business operations in Russia due to the invasion of Ukraine," Mauritsson said.

The specter of potential new data privacy regulations globally also continues to impact many new analysis and intelligence capabilities across the security industry. "Because of this, vendors must build any new solutions with the inherent privacy features already mandated in other regions or countries or have the inherent flexibility in their solution design that they can make quick changes in order to meet any new requirements that come into play," VanZandt said.

Growth prospects murky for physical security in 2023?

Indeed the security industry is seeing growth return this year. As for next year, things look more uncertain.

"In the first half of the year, our overseas business still maintained a rapid growth, thanks to the company's years of deep-rooted overseas efforts. It also continued to promote business localization strategies, and improved the global supply chain and various supporting systems. Business opportunities in Asia-Pacific, Africa, Latin America, and the Middle East are relatively optimistic; but there are also regions with relatively weak growth," said Fu Liquan, Chairman of Dahua Technology. "Looking forward, overseas businesses will continue to face regional factors, inflation and other objective conditions, but the global market is vast, with opportunities and challenges coexisting, and there is still growth potential in the long run."

Amid the challenges mentioned earlier, there is likely to be a correction in the market, impacting growth.

"The world market for video surveillance hardware and software is forecast to grow 11.7 percent in 2022. It is forecast that economic problems will impact both public and private spending on video surveillance equipment in 2023. At the same time, inflationary pressures will persist. The world market for video surveillance hardware and software is forecast to grow 6.4 percent in 2023," Woodhouse and Cropley said.

"While I don't expect that 2023 will be a total downturn in overall industry growth metrics, I do expect that it will cause a market correction, where growth metrics go from their high double-digit figures, and decrease back to a more sustainable, but significant 8-9 percent year-over-year," VanZandt said, adding while challenges remain, they also bring opportunities.

"Inflation concerns, supply chain challenges, and instability in global energy markets is all causing businesses to pause many new security investments until they can see what the final impacts could be to their budgets and bottom lines. This does offer opportunities for security vendors to work that much closer with their existing customers in order to identify ways that they can augment existing solutions already in use, giving vendors feedback on potential new features to introduce or to offer testing of new capabilities with these customers before restarting investment discussions," she said.

As for security trends for next year, AI, edge computing, cloud and cybersecurity will continue to dominate. Meanwhile, multi-dimensional perception will be another development to look for.

"From Hikvision's perspective, multi-dimensional perception will be another big trend that will enable the security industry going to the next level. Beyond visible light imaging, we see more perception capabilities, like radar, thermal imaging, x-ray screening, temperature measuring, humidity sensing, and gas leak detection that are being added to security devices and systems, making them more powerful," Zhang said. "By better 'sensing' the outside environment, identifying events, and providing more detailed information, multi-dimensional perception creates new possibilities for video security systems to be used in ever wider scenarios and applications. We are extending our machine perception technologies to the full electromagnetic spectrum, and have developed innovative products and applications that pick up X-rays, infrared rays, millimeter radar waves, sound waves, and temperature variations."

[A&S magazine]

asmag.com 2022.11.14 https://www.asmag.com/showpost/33173.aspx

|