PR Center

- Security 50: Top growth companies share their secrets to success

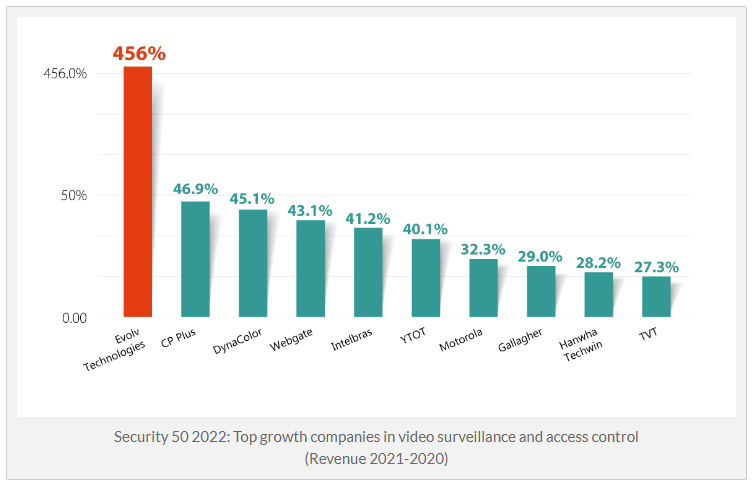

[A&S magazine] Security 50: Top growth companies share their secrets to success Taking a look at this year's Security 50, we can see clearly that growth has returned to the security industry. In this article we spoke with some of the growth companies to see what their secrets of success were.

Strategizing for growth

In total, 40 companies in this year's Security 50 reported growth last year, with 28 growing by double to triple digit. The Top 10 growth companies were: Evolv Technologies, CP Plus, DynaColor, Webgate, Intelbras, Dongguan Yutong Optical Technology, Motorola Solutions, Gallagher, Hanwha Techwin and TVT Digital Technology. Of note, Evolv, a provider of weapons detection security screening solutions, reported 2021 revenue of US$21.77 million, compared to $3.92 million for 2020 and translating into a y-o-y growth of 455.98 percent, due to the company's effort to add customers and expand into key verticals and geographic markets.

Indeed, these growth figures demonstrate security companies' strength and resilience amid various challenges presented by COVID. So how did they do it? We spoke with some of the growth companies to find out.

Staying nimble and responsive

Staying nimble and responsive amid adversity is critical. "All told, it's been a very interesting past couple of years, first dealing through Phase 1 of the pandemic in 2020, and then phase 2 in 2021. It was our supply chain that got us through these years. We were able to get ahead of the shutdown and pre-order 4x our general monthly orders for our main suppliers once we heard the World Health Organization was in Wuhan, China, knowing how quickly China closes when needed. Two days after our orders were placed, the shutdown happened. So having inventory was certainly a major factor, as much as having production teams willing to be in our headquarters building products for customer orders," said Jeff Burgess, Founder and CEO of BCD.

Value creation for customers

Another key to growth is value creation for customers who can continue to stick to the supplier.

Commitment to technology innovation

Closely related to value creation is technology innovation, which allows companies to deliver products/solutions required by users. "Identiv is designing and delivering next-generation solutions that are enabling the future of the IoT. We're a technically deep company, which is helping us to get more market share," Humphreys said. "Technology touches people every day and it's at our core and that drives across the premises business and the identity business, especially in RFID. Although finding great talent across all departments is a major challenge in security, we have some of the most innovative and brilliant engineering minds in the industry working in research and development. Those engineers are making the technology more deeply embedded, leveraging it more effectively, and then making it totally pervasive so that security is all-encompassing."

Respecting local laws and policies

For multinationals, respecting local laws and policies is key to ensuring growth in overseas business. "In the face of the current complex and changeable global political and economic environment, Dahua respects the laws, policies and customs of various countries and always complies with all applicable laws, regulations and business ethics of each market in which we operate to meet the requirements of globalization compliance," Fu said. "The company continues to strengthen the strategy for the localization of overseas employees by building an international marketing and management team as well as localized marketing and service centers to further explore the global market. Globalization and the continuous growth in overseas market will also contribute to future business growth of the company."

Growth expected to continue

Looking into 2023, most companies expressed optimism growth will continue. "We are very bullish about the security market because AI and Machine Learning open a whole new scale of possibilities, solutions, and integrations in and beyond security," Beernink said. "At, for example transportation clients like airports, we see that our clients are enormously challenged to keep their operations running whilst challenged on employees and being confronted with much higher passenger quantity. This as an example drives a demand for clever VMS security solutions. Security managers in our markets are challenged to do more with less resources. We at Milestone Systems have great solutions to fulfil that market trend."

[A&S magazine] asmag.com 2022.11.14 https://www.asmag.com/showpost/33174.aspx |